Payroll Changes in CMiC

As we begin using CMiC to process Payroll for Keeley’ns across all companies, it is important that everyone understand some changes that you might notice on your paycheck.

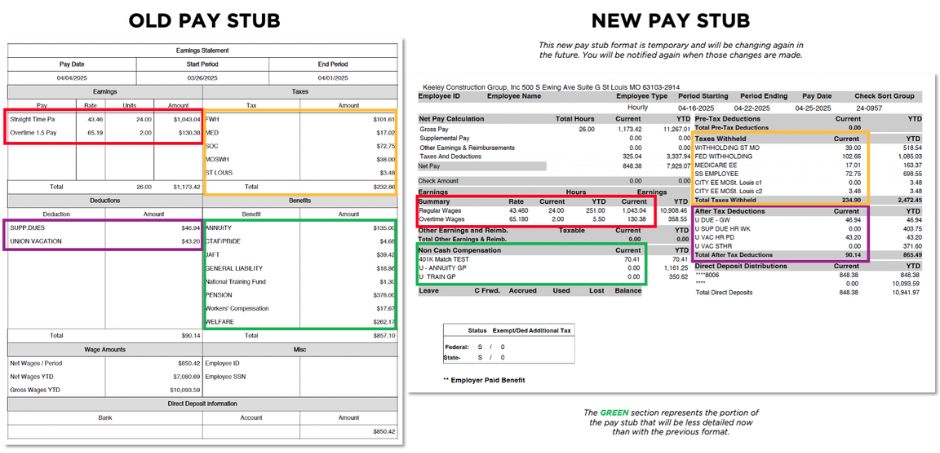

Pay stubs will look slightly different through CMiC than they do today. In some situations, this may mean there is slightly less detail on your pay stub than what is currently included. Rest assured – all required info will continue to be there including net pay, vacation, annuity, health & welfare, tax withholdings, etc.

The net pay may be slightly different than today, due to differences in how CMiC calculates payroll taxes. CMiC has a more sophisticated process for calculating taxes and withholdings than our current systems – this could result in your net (take-home) pay being slightly different than what you are used to seeing.

- If you do not live in the same state where you work, you may see more noticeable changes in your net pay. This is because CMiC has a better understanding of resident and work tax laws, and accounts for both home AND work location when calculating your taxes.

- As an example… Texas does not have state income tax, so under our current process, team members working in Texas who live in Missouri are not having Missouri state income tax withheld. Moving forward, CMiC will withhold income tax in your home state (if your home state requires it).

- If you live and work in the same state, you should notice very minimal to no change in your net pay.

For more information regarding Payroll changes, updating information in UKG, or who to contact for support, check out the full FAQ by clicking HERE.